Is Global Recession Imminent?

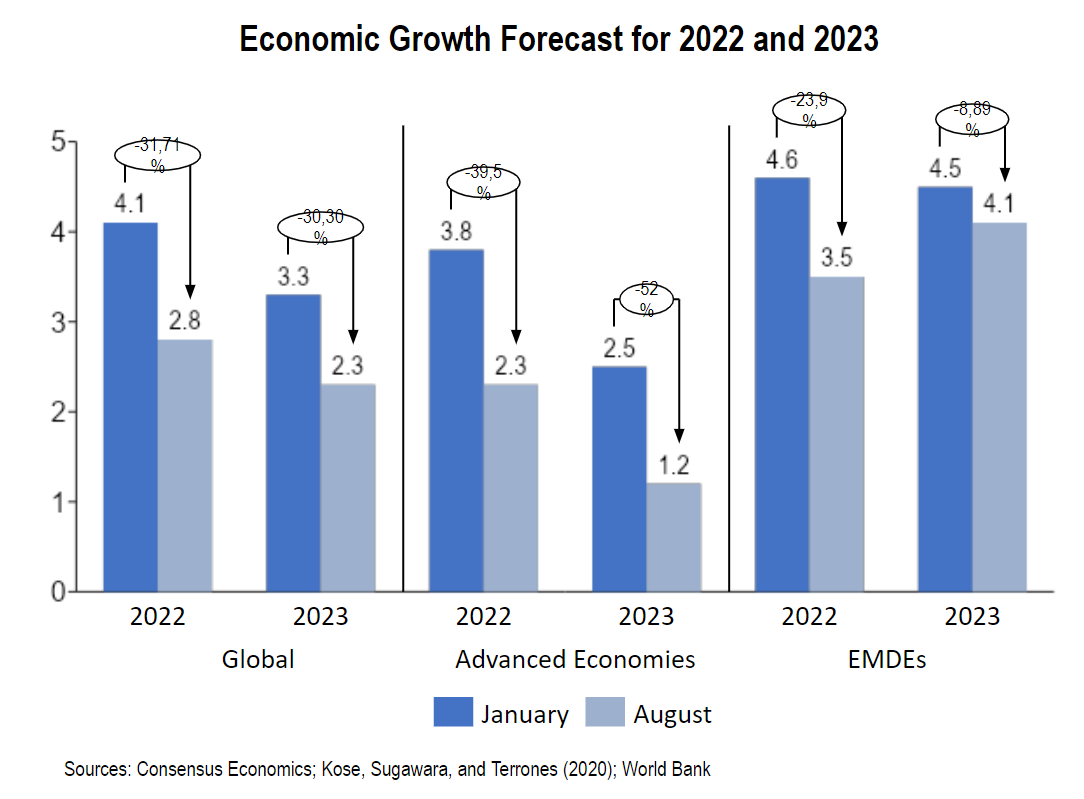

There have been a significant reduction in the consensus of 2022 and 2023 global growth forecasts. According to World Bank, the invasion of Ukraine by Russia along with continuous supply disruptions caused partly by the pandemic, and various tightening of macroeconomic policies to reduce inflation and reverse the pervasive measures taken during that time, are few of the most significant factors that contribute to this phenomenon

Previously in January 2022, consensus forecast of global growth was 4,1% for 2022 and 3,3% for 2023, but by August these forecast had been lowered to only 2,8% for 2022 (-31,7% change) and 2,3% for 2023 (-30,3% change).

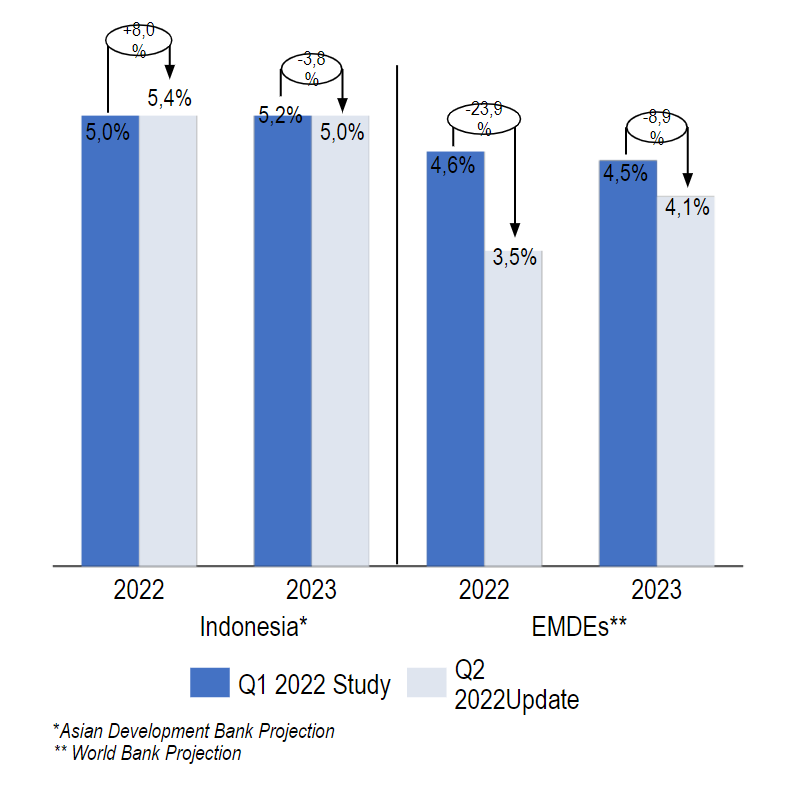

These downgrades mostly suffered by the advanced economies with changes of -39,5% and -52% for 2022 and 2023 respectively. EMDEs are forecasted to be relatively more robust, downgraded by only -23,9% and -8,9% for those years.

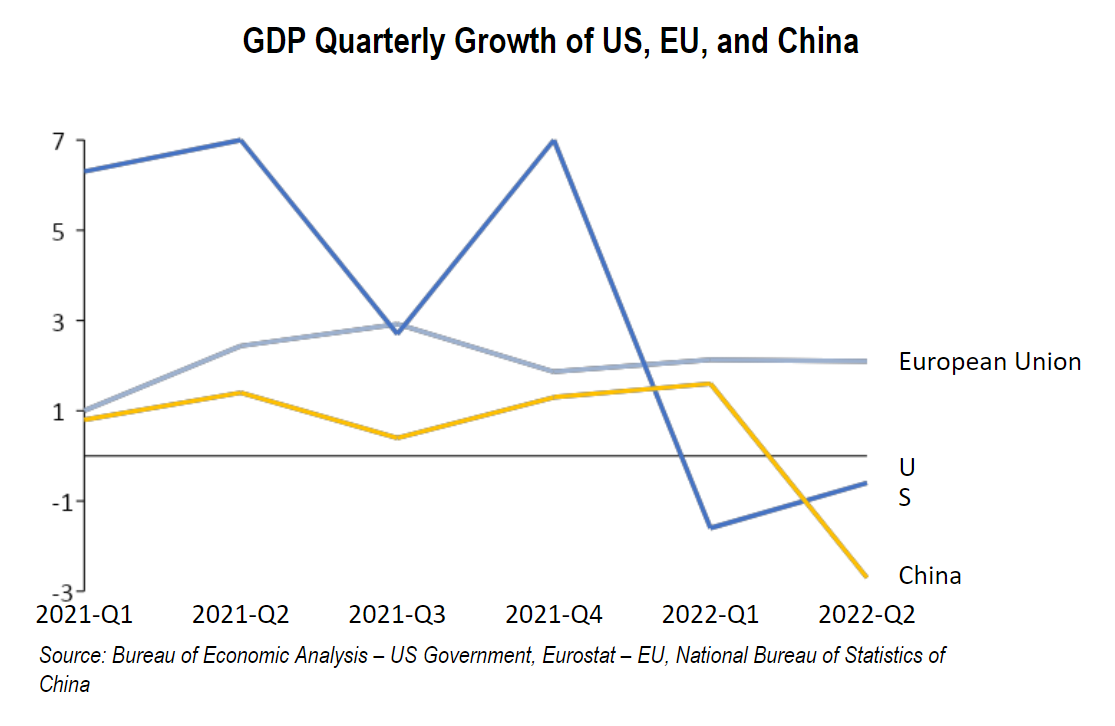

If we take a look on the quarterly growth of GDP of world’s largest economies (namely US, EU, and China), we indeed could see some serious deceleration.

Despite a recent recovery from the economic effects of the COVID-19 pandemic, the US GDP suffered a negative growth of 1.6% and 0.6% in Q1 and Q2 2022 triggering a strong signal of economic recession in the country.

China is facing a similar problem, countless lockdowns from the Zero COVID Policy implemented by the government and the burst of property sector bubble, are the two of the most significant factors contributing to economic contraction in Q2 2022.

EU is currently on stagnation, but as the energy crisis is still have no end in sight and is affecting EU’s economic powerhouses, as well as the threat of an upcoming food crisis, there is no guarantee that EU won’t fall into economic recession as well.

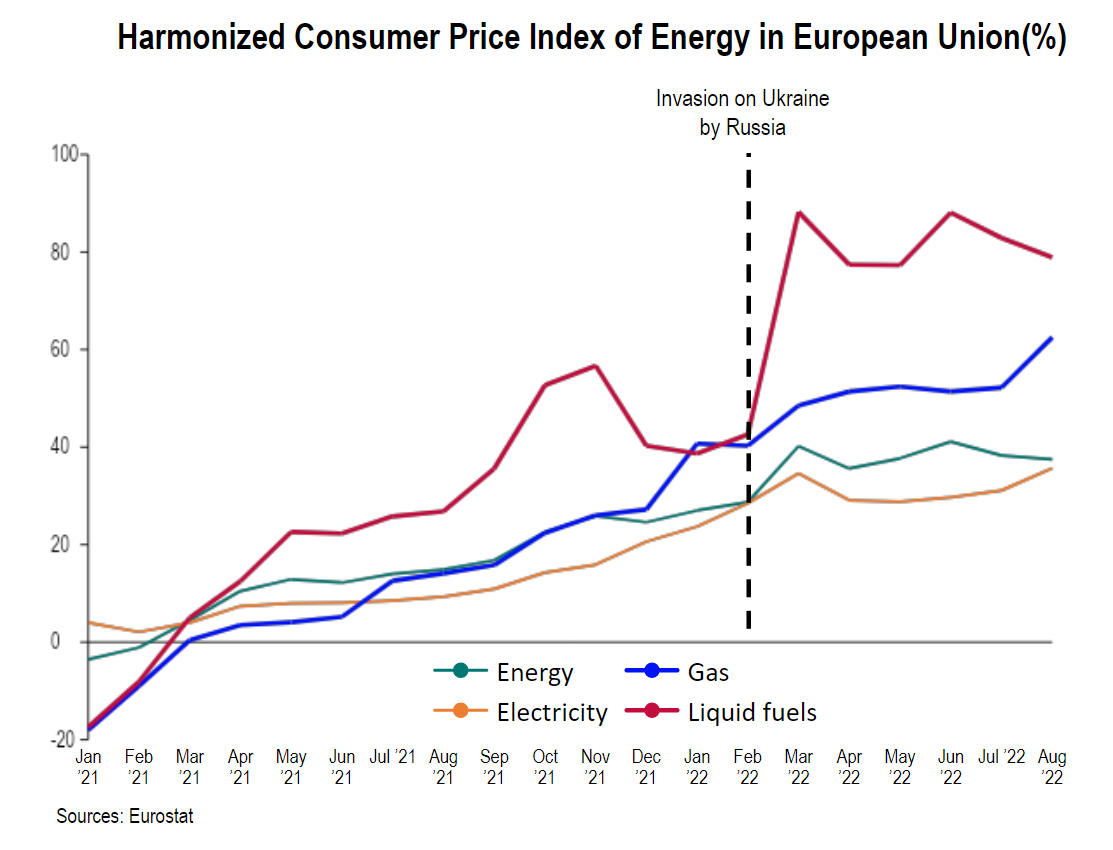

Energy Crisis in EU

The Ukraine invasion by Russia has triggered a series of event that led to the energy crisis in Europe as most of EU is still dependent on Russia’s gas and oil supply. As the result, starting in February 2022, the price of energy commodities in EU has skyrocketed particularly Liquid Fuels and Natural Gas.

Currently, EU has managed to fill its gas storage to 90% ahead of winter, according to the International Energy Agency’s quarterly report. However, behavior change and cutbacks may be needed if Russia reduces gas exports further, which could reduce the economic output particularly in manufacturing sector, further adding downward pressure to the GDP growth.

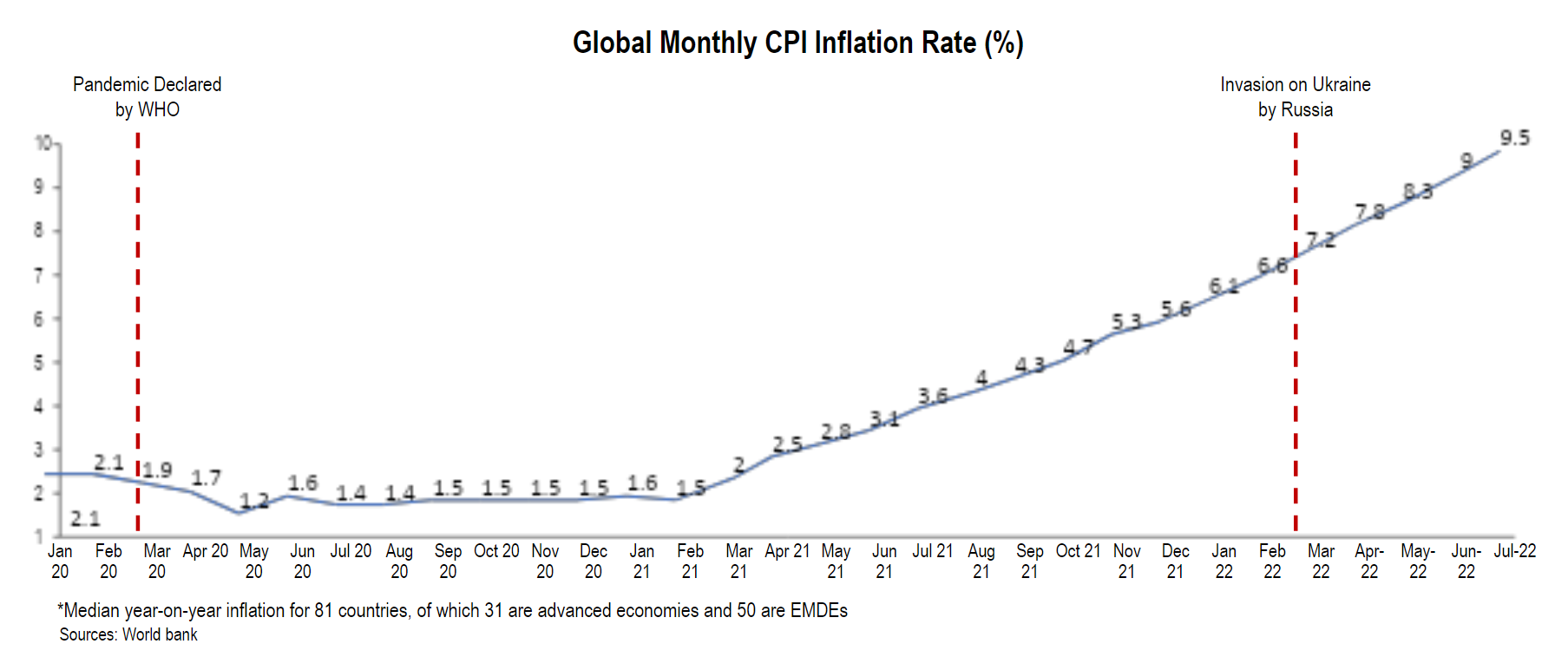

According to the World Bank, CPI Inflation is steadily increasing since February 2021 to multi-decade highs and shows no sign of slowing down in multiple countries in Advanced Economies as well as in EMDEs. The rising energy price have only made the inflation more persistent and more difficult to contain.

Monetary Policy Responding the Inflation

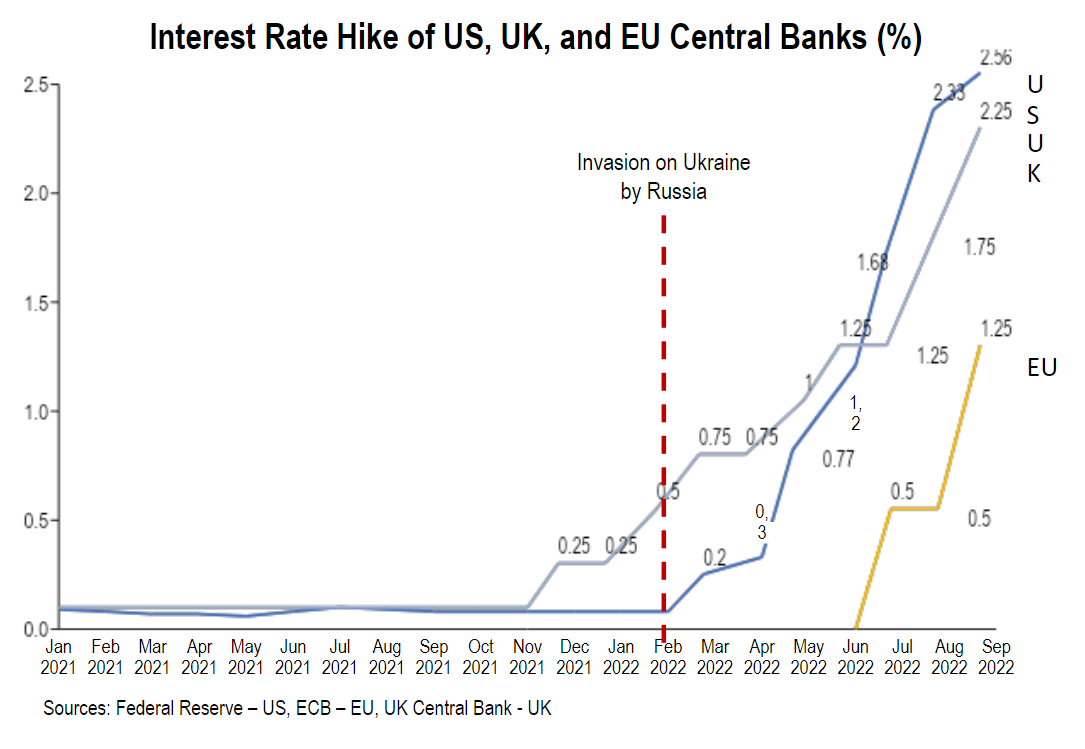

As the result of persistent inflation growth, central banks of many countries have risen their policy interest rate steeply. World Bank calls this the most internationally synchronous episodes of monetary policy tightening of the past five decades.

The Effective Federal Funds Rate of the US are rising faster than any other time in recent history, reaching 2.6% in only 6 months. European Central Bank hikes interest rates for first time in 11 years and expected to continue rising to as high as 2%. UK Central Bank reached the highest interest rate since 2008 in August 2022 at 1,8%.

These policy actions are necessary to contain inflationary pressures, but their mutually compounding effects could produce larger impacts than intended, both in tightening financial conditions and in steepening the growth slowdown.

Sources: World bank, BPS, tradingeconomics.com, antaranews

How About Indonesia?

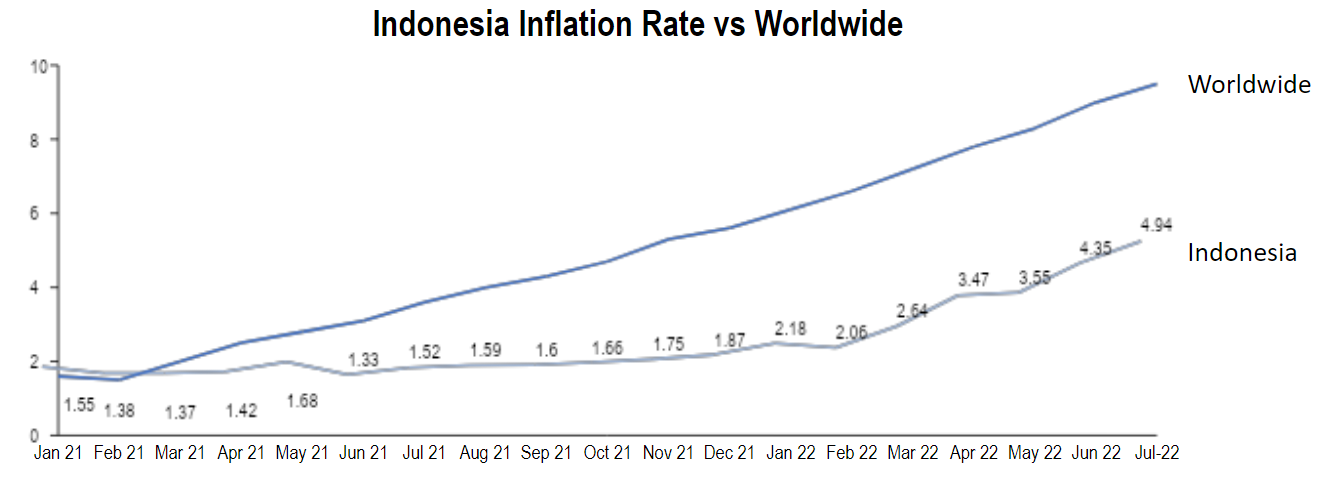

Increasing inflation is also becoming a problem, Indonesia’s annual inflation rate accelerated to 4.9% in July 2022 and continues to increase to 5.95% in September 2022, the highest level since October 2015. The inflation rate was above the upper limit of the central bank’s 2-4% target range for the fourth straight month. Main upward pressures largely came from cost of food (7.91% vs 7.73% in August), transport (16.01% vs 6.62%), housing (3.19% vs 3.11%), furnishings (5.04% vs 4.89%), food & restaurant (4.53% vs 4.20%), education (2.61% vs 2.50%), and clothing (1.56% vs 1.63%). By contrast, cost of information & financial fell further (-0.31% vs -0.29%).

However compared to the rest of the world, Indonesia have a much slower rate of increase. Coordinating Minister of Economic Affairs Airlangga Hartarto said that “Indonesia’s inflation, at a well-maintained 5.9-percent level, makes the country among the five countries with the lowest inflation rate in the world”. Self-sufficiency of staple food production keep the volatile food relatively under control, keeping inflation stable, despite lower government subsidies on fuel price.

Bank Indonesia’s Response to the Inflation

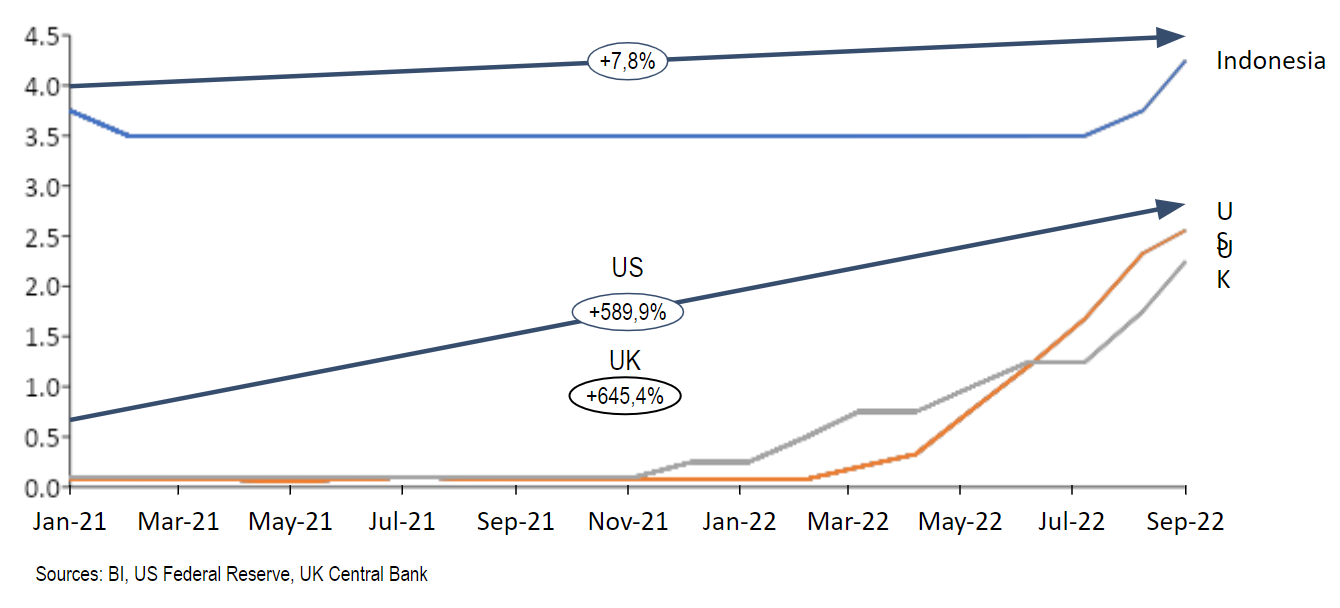

Despite relatively moderate inflation, BI have started to hike its policy interest rate in August 2022 to 3.75% and September 2022 to 4.25% (previously 3.5% from February 2022). This hike is very moderate with a compounded growth rate of 7.8% making BI among the least hawkish central bank in the world. Comparatively, The Fed and UK Central Bank each has a compounded growth rate of their interest rate of 589.9% and 654.4% respectively for the same period.

Forecasted Economic Growth of Indonesia

Indonesia is forecasted to be a more robust economy compared to consensus growth of EMDEs. For 2022, Indonesia’s GDP growth projection actually has been upgraded to 5.4% compared to 5.0% in the previous projection. In contrast, growth projection of EMDEs is downgraded to 3.5% from 4.6%.

For 2023, Indonesia’s GDP growth has been downgraded to 5.0% from 5.2% in the previous forecast (3.8% decrease). However, this downgrade is significantly more moderate. Comparatively, consensus projection of EMDEs is downgraded to 4.1% from 4.5% (8.9% decrease).

Indonesia’s Economic Robustness in Global Recession Perspective

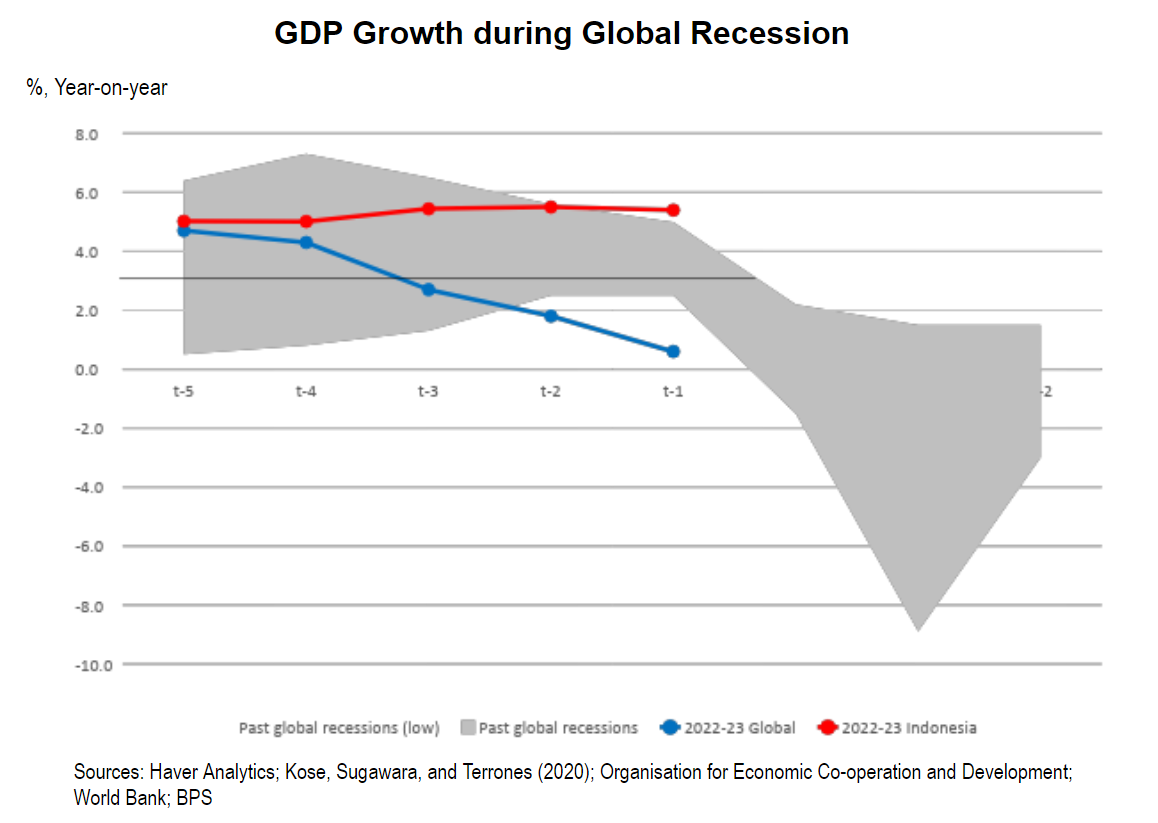

World Bank constructed a model that shows the range and movement of global GDP growth in past global recessions (i.e., 1975, 1982, 1991, 2009, and 2020), based on quarterly data. The model shows the pace of the decline of projected global growth over the past year (consensus forecast of 45 countries) has been much faster than that during periods preceding earlier global recessions.

If we put Indonesia’s past and projected GDP growth in this perspective, we could see that the economy of Indonesia is currently, and predicted to be stable until Q4 2022, despite the downward pressure that usually comes preceding a global recession.