Essentially, diversification is a strategy to reduce risk by spreading resources across various fields, sectors, or assets. This applies to multiple aspects such as investment, business, or products.

Meanwhile, portfolio diversification is a widely known strategy in finance and business, used to expand the range of products, services, or markets to reduce risk and increase growth opportunities.

By diversifying, a company does not rely solely on one business line or market segment but has multiple revenue sources that help it withstand economic uncertainty and industry competition. As mentioned earlier, the term portfolio refers to the collection of businesses, products, or services owned by a company.

The primary benefit of corporate portfolio diversification is financial stability. This means that if one business line declines, another can support the company, reducing financial risks.

A successful example of portfolio diversification is Apple. Initially, the company focused on the computer business with its Macintosh product. However, its portfolio diversification began when it launched the iPod in 2001, followed by the iPhone in 2007, which has now become the company’s backbone.

As a result, the iPhone now contributes more than 50% of Apple’s total revenue, while its digital services continue to grow rapidly. This diversification strategy has enabled Apple not to depend solely on one product but to have multiple strong revenue sources.

Moreover, diversification fosters innovation, enhances competitiveness, and provides flexibility in responding to market changes. However, this strategy also presents challenges such as increased management complexity, potential loss of focus, and significant investment risks in unfamiliar sectors.

So, how can a company build a successful portfolio diversification strategy? Here are some essential tips!

Discover More : Factors Influencing Demand and Supply

Types of Corporate Portfolio Diversification

Before diving into portfolio diversification strategies, it’s crucial to understand the two main types of portfolio diversification: related diversification and unrelated diversification.

Related Diversification

Related diversification occurs when a company expands its business into industries or products closely linked to its core business. This connection may be in the form of supply chains, technology, markets, or core competencies. This strategy allows companies to leverage existing resources, create synergy, and strengthen their position in the industry.

For example, Toyota initially produced gasoline-powered cars but later developed hybrid and electric vehicles, staying within the automotive industry but with more advanced and environmentally friendly technology

Unrelated Diversification

Unrelated diversification happens when a company enters industries or businesses with no direct connection to its primary business. The main goal of this strategy is to reduce risk by having a business portfolio across various sectors.

A prime example is Samsung, which operates not only in the electronics industry (smartphones, TVs, and semiconductors) but also in construction (Samsung C&T), insurance (Samsung Life Insurance), and heavy industries (Samsung Heavy Industries).

6 Strategies Corporate Portfolio Diversification

1. Conduct Thorough Research

Before diversifying, companies must conduct in-depth market research. Data collection includes various critical aspects that help companies understand market conditions and prospects. Methods for gathering market data include:

- Industry Trend Analysis: Monitoring industry developments, including innovations, new regulations, and changes in consumer preferences.

- Consumer Demand Studies: Understanding customer needs, desires, and purchasing behavior to assess market attractiveness.

- Competitor Research: Identifying the strengths and weaknesses of competitors in the target market to determine competitive advantages.

- Economic Data Analysis: Evaluating factors like income levels, inflation, and purchasing power that influence diversification success.

- Market Testing and Customer Surveys: Conducting interviews, surveys, or direct observational studies to gain accurate insights into consumer preferences and needs.

- Big Data and AI Utilization: Modern technology enables companies to collect and analyze large volumes of data to detect hidden patterns and trends.

With accurate and relevant data, companies can assess whether a new market presents promising opportunities or high risks. Good market data collection is the foundation for developing an effective diversification strategy.

2. Understand Market Trends and Consumer Behavior Before Diversifying

Market trends indicate shifts in industries, such as increasing demand for eco-friendly products, the growth of digital markets, or changes in consumption patterns due to new technology. Meanwhile, consumer behavior reflects how customers make purchasing decisions, factors influencing their loyalty, and their expectations of brands or products.

After conducting research, companies must understand how markets evolve and how consumer preferences change before expanding their portfolio.

For instance, if trends show a growing interest in green technology, companies may consider investing in renewable energy sectors. By conducting thorough research and surveys, companies can minimize risks, increase profit potential, and ensure that diversification provides optimal long-term benefits.

If companies fail to understand market trends and consumer behavior, diversification may carry high risks, as new products or services may not align with market needs. For example, if an electronics company wants to enter the electric vehicle industry, it must understand market demand, regulations, and factors influencing consumer purchasing decisions before investing in a new business line.

By conducting in-depth market research, companies can identify potential opportunities, minimize risks, and ensure their expansion adds value and provides a sustainable competitive advantage.

3. Ensure New Products or Services Meet Target Customer Needs

Companies must ensure that new products or services are relevant and valuable to customers. Diversification without considering market needs can lead to failure, as customers may not be interested in or require the offered products.

For example, if a fashion company wants to expand its portfolio into cosmetics, it must ensure that its cosmetic products align with the tastes and lifestyles of its existing customers, making it easier for them to accept the new products.

Additionally, marketing and communication strategies should be adjusted so customers understand the benefits of the new offerings. By focusing on customer needs, companies can increase success chances, build customer loyalty, and expand their market share effectively.

Discover More : 7 Strategies for Financial Management: Boost Business Growth

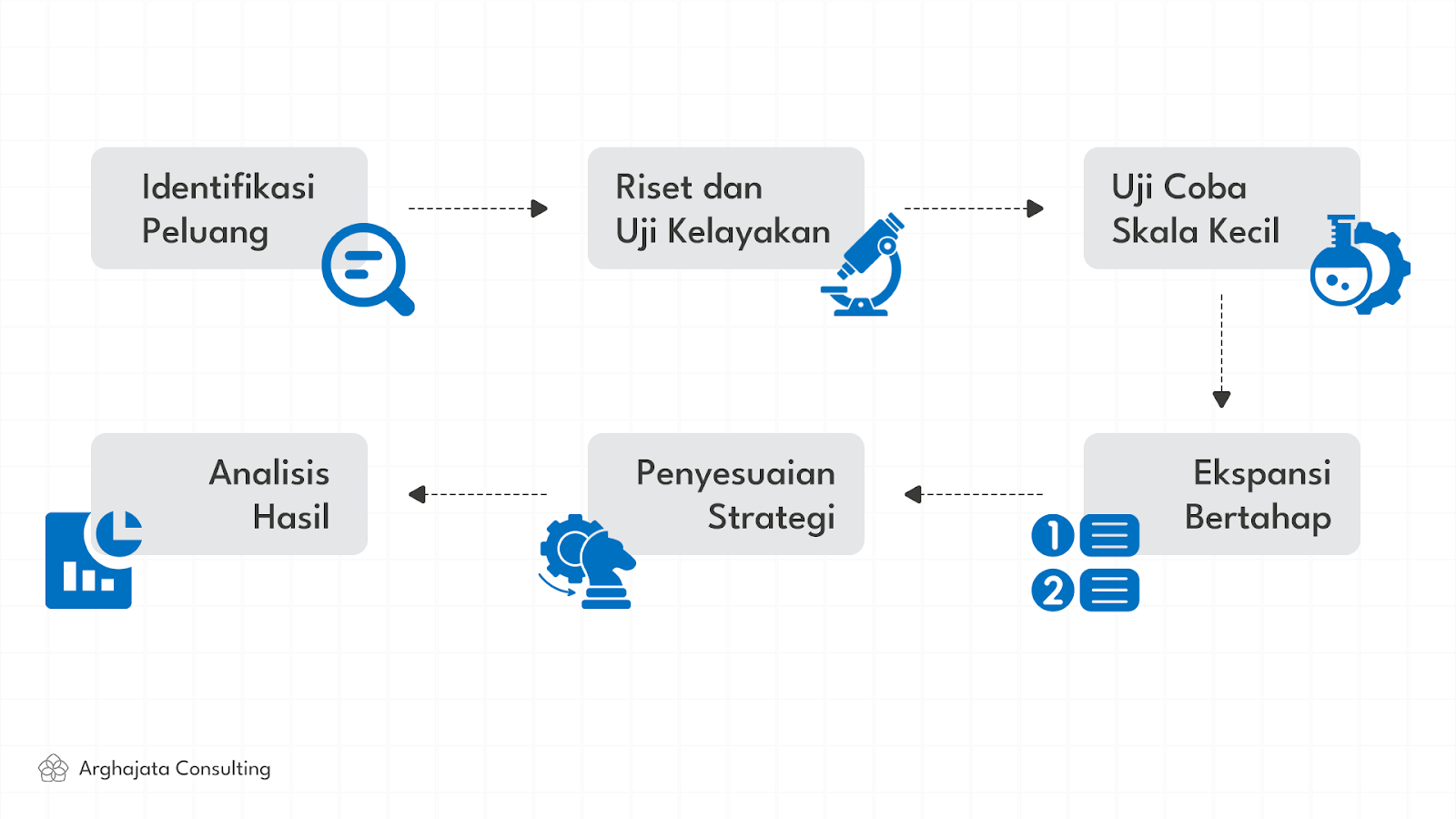

4. Implement Gradual Diversification with Small-Scale Testing

Companies should not immediately implement large-scale diversification without first testing the feasibility of their strategy. This approach helps identify potential risks, understand emerging challenges, and evaluate strategy effectiveness before allocating significant resources.

For example, if a retail company wants to diversify into e-commerce, it can start by launching an online store on a limited scale or offering a few flagship products first. This allows the company to gauge market response, identify logistical challenges, and assess profitability before expanding operations fully.

By gradually diversifying, companies can reduce failure risks, ensure alignment with market needs, and optimize strategies based on initial test results.

By following the steps above, companies can ensure that diversification is carried out with careful planning, minimize risks, and increase the chances of long-term success.

5. Do Not Neglect the Core Business

Diversification is essential for reducing risks and increasing growth opportunities. However, if not managed properly, it can divert attention and resources from the core business, which is already stable and profitable.

For example, a food and beverage company looking to invest in technology may risk diverting financial and managerial resources away from its main business. As a result, its primary operations might suffer, losing competitiveness and profitability.

Therefore, companies must balance diversification efforts while maintaining the stability and growth of their core business.

6. Use KPIs to Measure Diversification Success Regularly

Companies should continuously monitor and evaluate the effectiveness of their diversification strategy using Key Performance Indicators (KPIs), such as revenue growth, profit margins, Return on Investment (ROI), market share, and customer satisfaction.

For example, if a company has diversified into a new sector, it should track how much that sector contributes to overall revenue and whether its growth aligns with set targets.

All in all, portfolio diversification is a crucial strategy for companies to reduce risks, enhance growth opportunities, and expand market reach. However, for diversification to be successful, companies must implement the right and well-measured strategies.

By following these six strategies, companies can optimize portfolio diversification more effectively, increase competitiveness, and drive sustainable business growth.

Don’t let risks hinder your business growth. With the right portfolio diversification strategy, you can increase your chances of success and strengthen your company’s competitiveness. Arghajata Consulting is ready to assist you in designing an effective diversification strategy, based on market research and tailored to your business and customer needs.