Financial management is more than just numbers. In business, managing finances serves as the foundation that determines operational stability and growth opportunities. Without a well-directed financial strategy, businesses are vulnerable to risks that could threaten their sustainability.

But how can you ensure that the financial policies you establish are not only efficient but also relevant to market dynamics? To address this, we’ve outlined strategic steps to manage your company’s finances effectively.

Each tip is designed to help you craft policies that not only maintain stability but also unlock growth opportunities.

1. Understand Your Current Financial Position

The first step in managing your company’s finances is to understand your current financial position. Without a clear understanding, it will be challenging to set a strategic direction for the future. You can begin this process with the following steps:

- Conduct an in-depth evaluation of past financial statements: These reports provide insights into the company’s profitability, liabilities, and solvency over a given period.

- Implement financial performance dashboards: Use key performance metrics to assess whether your financial performance is categorized as strong or weak. Compare actual financial performance with previously established targets to identify gaps.

- Analyze trends: This step is crucial for understanding whether the company’s financial performance is improving over time.

However, internal financial performance should not be evaluated in isolation. It must also be benchmarked against external factors, such as market dynamics and competitor performance.

In some cases, even if your financial targets are met, the results might fall short of the broader market’s growth potential.

This analysis will provide an initial indication for setting your next financial goals. If the financial position is stable or positive, you can adopt a more aggressive growth strategy, such as investing in business expansion.

Conversely, if the financial position is negative, the priority should be on cost efficiency and productivity improvements through a more conservative approach.

2. Set Clear Financial Goals

After understanding your financial position, the next step in managing company finances is to establish clear and measurable goals. These are not just numerical targets but strategies that encompass both short-term and long-term objectives.

This is where streamlining between forecast (financial projections) and budgeting (financial allocation) plays a crucial role. In financial planning, the forecast provides a strategic overview of target revenues, debt projections, and future profitability. Meanwhile, budgeting translates these forecasts into measurable financial allocations and actionable operational steps for daily execution.

For example, a forecast might set a revenue target of IDR 5 trillion by 2026, based on an assumed annual sales growth of 10% through market expansion and the launch of innovative products, with projected costs of IDR 1 trillion.

Budgeting then breaks down how resources will be allocated to achieve this target. For instance:

- IDR 500 billion allocated for developing new products to drive innovation.

- IDR 300 billion for aggressive marketing strategies in new markets.

- IDR 200 billion for expanding distribution networks to increase market reach.

Thus, budgeting becomes the concrete action plan that bridges the strategic intent of forecasts with operational implementation. This process can be approached in two ways:

- Top-down: Driven by directives from senior management or higher-level strategy.

- Bottom-up: Derived from operational-level inputs and work plans.

By ensuring alignment between forecast and budgeting, you create a financial strategy that is both realistic and actionable. Below are some common budgeting methods used in business:

Discover more: The Importance of Good Financial Management in Business

Incremental Method

The Incremental method involves adjusting the previous year’s financial data based on an increase or percentage relevant to the current conditions. This method does not rely on fixed formulas, as it is flexible and tailored to the company’s needs.

For example, if a company had a budget of IDR 7 billion last year but actual expenses reached IDR 10 billion, this year’s budget needs to be adjusted to better reflect actual needs and anticipate uncontrolled overspending as seen previously.

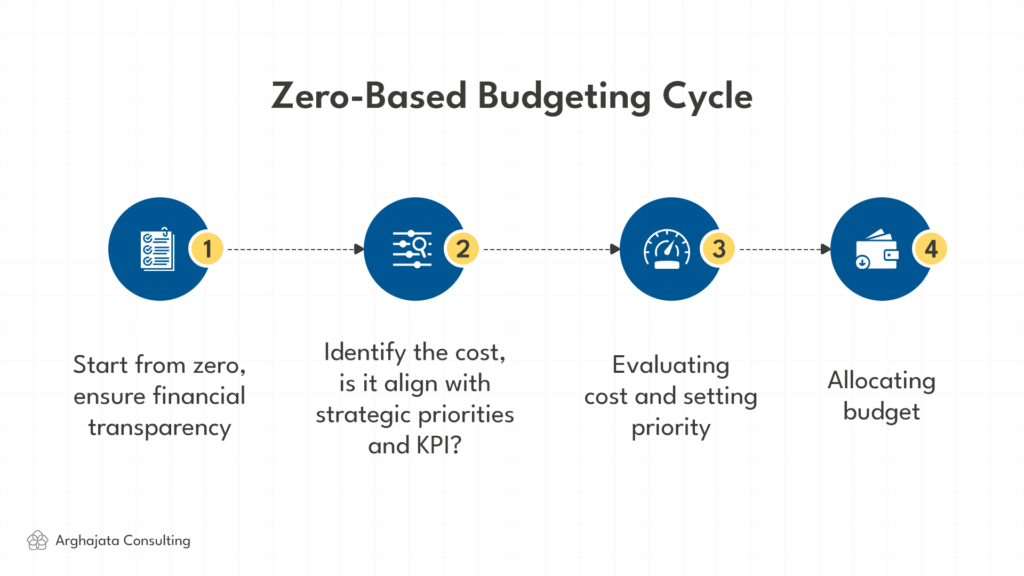

Zero-Based Method

The Zero-Based Budgeting (ZBB) method requires starting from scratch every year, with every budget component designed anew. In this method, budgets are constructed as though they are brand new, requiring a detailed examination of all expenses to determine which ones are genuinely important and relevant.

This approach is one of the most commonly used and rigorous financial management methods, aimed at eliminating unnecessary expenses and optimizing profits.

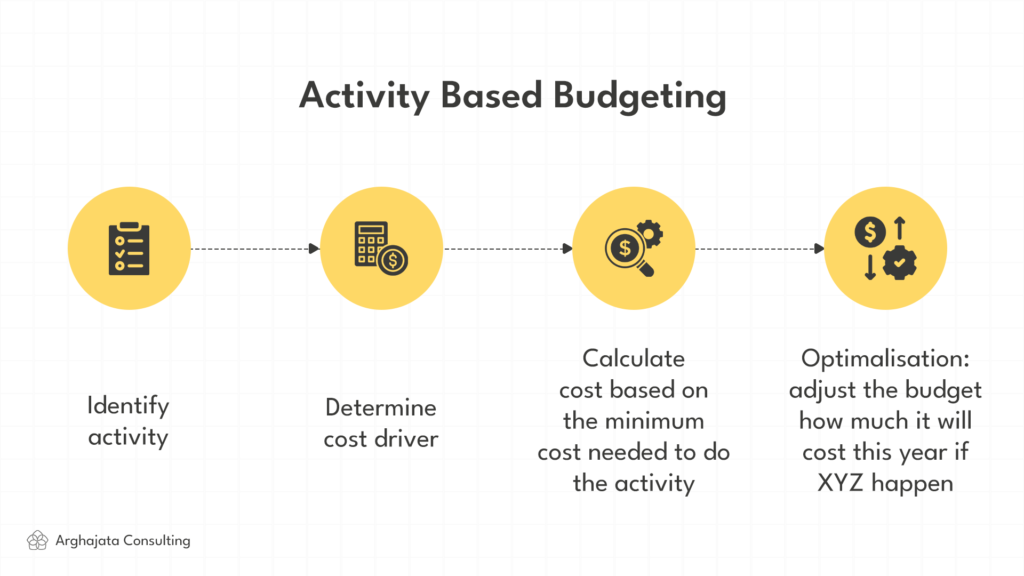

Activity-Based Budgeting

Another widely used budgeting method is Activity-Based Budgeting (ABB). This approach focuses on budgeting based on activities that incur costs.

Essentially, this involves identifying key activities within a business and analyzing the drivers of revenue and costs for those activities.

Activity-Based budgeting is particularly useful for assessing the pricing and profitability of different products or activities. It helps businesses make informed decisions about which areas to expand or scale down.

Value Proposition Budgeting

The Value Proposition budgeting method evaluates the value generated by each expense. The primary goal of this method is to ensure that the budget focuses on opportunities that enhance the company’s value.

This type of budgeting requires detailed justifications to prove that every item contributes value to the business and is worth its cost. If an item is found to be more expensive than its value, it is removed from the budget, and the funds are reallocated accordingly.

Value Proposition budgeting is rarely used in isolation. It is often combined with other budgeting methods, such as Activity-Based Budgeting, for a comprehensive approach.

3. Create a Detailed Budget and Cash Flow Policy

Once the financial strategy is established, the next step in managing company finances is effectively managing cash flow. Cash flow serves as the most tangible indicator of your business activities. By analyzing cash flow, you can clearly understand what is coming in (inflows) and going out (outflows).

However, cash flow management is not solely about income and expenses. In business, managing receivables and payables also plays a crucial role. For example, a company providing O&M services for heavy equipment must promptly collect payments from clients to maintain liquidity (receivables).

On the other hand, the company must also manage its payables to equipment vendors, including negotiating payment terms or securing purchase discounts. This type of management not only ensures smooth cash flow but also helps the business maintain sufficient funds for daily operational needs.

4. Manage Debt Wisely

Debt often acts as a double-edged sword. On one hand, it can be a powerful tool to accelerate growth. On the other, poor debt management can push a business to the brink of bankruptcy.

Therefore, it is crucial to carefully consider interest rates, repayment terms, and the company’s repayment capacity before taking on new debt. Managing debt wisely enables a business to maintain financial stability while avoiding unnecessary risks.

Discover more: Profit and Loss Analysis as a Key to Business Development Success

5. Make the Right Investment Decisions in Managing Financial

Investment is one of the best ways to optimize a company’s finances. However, the scope of investment here is not limited to the acquisition of operational assets, such as new equipment or technology.

It also includes strategic investments, such as mergers and acquisitions (M&A), to expand market reach or enhance company capabilities. Ensure that any investment aligns with the company’s strategy, whether it is a productive strategy or a growth strategy.

6. Implement a Financial Oversight System

Strong financial management is not only measured by numbers but also by the transparency and accuracy of its processes. Adopting accounting software can help automate recording, reporting, and real-time financial monitoring.

With a robust oversight system in place, you can ensure that every financial policy is executed as planned.

7. Conduct Regular Financial Audits and Evaluations

Routine audits provide two key benefits: ensuring the accuracy of financial reports and preventing potential fraud. Additionally, financial evaluations allow you to track business progress over time, assess whether targets have been met, and identify corrective actions needed for the next period.

Ultimately, finance is the cornerstone of a business’s sustainability and growth. With effective management, companies can not only maintain financial stability but also seize opportunities for sustainable growth. However, optimal financial management must be supported by competent human resources and the strategic use of appropriate technology.

If you need further guidance in designing an optimal financial policy, Arghajata Consulting is here to help. Contact us to begin your journey toward professional and efficient financial management.